Screening tenants with a FICO Score

Screening tenants with a FICO Score is a good practice. A credit report is often requested by property managers or community homeowner associations when screening a prospective tenant or buyer. Credit reports are an integral part of a background check but interpreting the data can be more difficult than you think. A FICO Score can help interpret the data and lend objectivity to the review process making for a compliant and highly useful background check.

Credit Bureaus

All three credit bureaus – Transunion, Equifax and Experian – can provide a FICO Score as part of the credit report. The FICO Score evaluates 5 main information categories – Types of Credit in Use, New Credit, Amounts Owed, Length of Credit History and Payment History. Age, salary, occupation, residency, personal information restricted by the Equal Credit Opportunity Act and certain types of inquiries are not applicable to the score calculation.

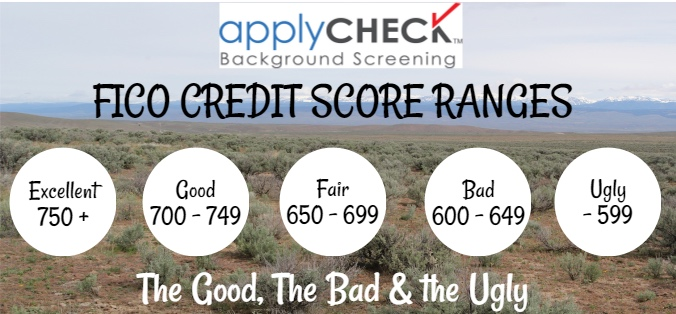

FICO Score Ranges

FICO scores range from 300 to 850. The scores are generally categorized as follows:

- Excellent Credit: 750+

- Good Credit: 700-749

- Fair Credit: 650-699

- Poor Credit: 600-649

- Very Poor Credit: below 599

Using accumulated data, the FICO Score estimates the probability a prospective tenant will be delinquent in a payment over 90 days in the next 2 years. This can be a very helpful indicator of future payment history. On the top end, those with scores of 750 or higher have a 2% chance of defaulting on payments. Conversely, those with scores less than 500, have an 87% chance of being late in payments 90 days or more.

Credit Report with a FICO Score

By running a full credit report and not a credit summary, you can also look at the reasons for the low score and determine if the issues contributing to the low score may be an indication the prospective tenant may have difficulty paying the required rental or maintenance payments.

Screening tenants with a FICO Score has proven to be an effective, fair and accurate method to determine the likelihood of a prospective tenant’s future payment history whether that person has a long or short credit history. The FICO Score is the best known and most widely used credit score. It is an invaluable tool and provides an objective and quick analysis of a prospective tenant’s credit history. Property Managers and Community Homeowner Associations would be well advised to order a credit report with a FICO Score as it contributes to the completion of a thorough, objective and accurate background check.

>