Mobile Home Park Background Screening

Mobile home park background screening is very affordable and can improve the safety and financial viability of your community. Background screenings help ensure potential buyers or tenants are reliable and financially responsible. These screenings typically involve checking criminal history, evictions and credit reports. In addition, credit reports offer valuable insights into an applicant’s financial stability, patterns of financial behavior, past payment issues or high debt levels. By integrating mobile home park background screening into the application process, mobile home park managers can better assess the risk of non-payment and avoid potential issues with tenants or buyers.

Legal Considerations for Using Credit Reports

Fair Credit Reporting Act (FCRA) Compliance. The FCRA governs the use of credit reports and requires that you follow specific procedures when obtaining and using this information. You must obtain written consent from the applicant before pulling their credit report. Additionally, you must provide a copy of the credit report and a summary of the applicant’s rights under the FCRA if you make an adverse decision based on the credit report.

Written Consent: Before obtaining a credit report, you must secure written consent from the applicant. This consent must be clear and specific, allowing you to access their credit history (15 U.S.C. § 1681b(b)(2)).

In addition to federal regulations, various states and local jurisdictions have their own laws governing the use of credit reports in tenant screenings. These laws can vary significantly, so it’s important to use a professional background screening agency. For instance:

California: California’s Credit Reporting Agencies Act provides additional protections, including restrictions on how and when credit reports can be used in rental decisions (Cal. Civ. Code § 1785.20.5).

New York: New York law requires that any adverse action taken based on a credit report must be accompanied by a notice that provides the applicant with information on how to obtain a copy of their credit report and dispute any inaccuracies (New York General Business Law § 380-e).

How to Effectively Implement Credit Reports in Your Screening Process

Establish clear criteria for what constitutes an acceptable credit history. This might include specific credit score thresholds or guidelines regarding recent financial issues. Consistent application of these criteria helps ensure fairness and transparency in the screening process.

Combine credit reports with other screening elements, such as an eviction search or criminal search, to get a full picture of the applicant. This holistic approach helps you make informed decisions and minimizes risk.

Bankruptcy, Liens and Judgment Search

Credentialing is required under federal law to protect consumer data. Individual Landlords and small homeowner associations may not be able to pass the credentialing requirements to receive credit reports directly. For these situations, Applycheck provides a Bankruptcy, Lien and Judgment search.

The Bankruptcy Search includes:

- Debtor name, address, file number and file date, chapter type, court district

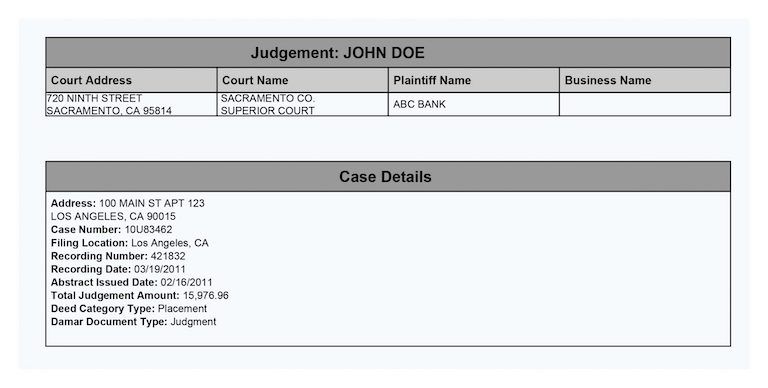

The Liens and Judgment Search includes:

- Debtor name, address, court case number and date, filing location, judgment or lien amount.

The Bankruptcy, Liens and Judgment Search reports negative financial records of the applicant. These are nationwide searches. For example, if the landlord received a money judgment, the judgment appears on this report. This search does not report lines of credit detailed in a credit report, but significant negative payment issues of the applicant may appear. A bankruptcy, lien and judgment search provides the landlord or property owner a look into the financial history of the applicant.

Benefits of Mobile Home Park Background Screening

Reduce Financial Risk Incorporating credit reports into your screening process helps mitigate the risk of renting to individuals who may not meet their financial obligations, protecting your property’s revenue.

Improve Tenant Quality A thorough screening process leads to selecting more reliable and financially responsible tenants, contributing to a more stable and positive community environment.

By preventing potential issues before they arise, comprehensive background checks reduce the need for costly evictions and tenant turnover, simplifying property management.

What are the Most Common Screening searches?

- SSN Validation

- National Criminal Search

- Sex Offender Registries Search

- US Most Wanted/Terrorist/FBI Most Wanted

- Office of Foreign Assets Control (OFAC) – for potential matches on the Specially Designated Nationals (SDN) List or Non-SDN Consolidated Sanctions List. This consolidated list includes the Foreign Sanctions Evaders List, the Sectoral Sanctions Identifications List, the List of Foreign Financial Institutions Subject to Correspondent Account or Payable-Through Account Sanctions, the Non-SDN Palestinian Legislative Council List, the Non-SDN Menu-Based Sanctions List, and the Non-SDN Communist Chinese Military Companies List.

- Eviction Search

Can I use the Internet to Screen my Volunteer?

An organization may wonder if they should do the background checks themselves. A great deal of information can be found on the Internet. Information can often be had just by googling a person’s name. In addition, many websites offer background checks on anyone, without applicant authorization. Some websites sell criminal history records with little regard to the privacy protections included in the FCRA. These websites may not adhere to FCRA regulations unlike reputable background screening agencies. The data quality, accuracy, and completeness of information gleaned from such unregulated sources may vary widely. Generic background screening websites may even prove more costly in the end than a professional screening agency as charges mount up for each jurisdiction searched.

Benefits of Using a Professional Background Screening Agency

- Reduce fraud and theft

- Compliance with FCRA laws

- Compliance with legal requirements

- Aides in Public Safety

- Reduce lawsuits due to negligence

- Reduce loss of business

What is Applycheck?

Applycheck is an authorized credit reporting agency providing background screening to property managers, homeowner associations, religious organizations, and individuals. To make your screening process easy and efficient, we provide both paper and a paperless online application process with applicant information saved in the cloud.

Applycheck does not have monthly fees, minimums, or set up fees. Our mission is to deliver detailed and accurate reports, at a price that doesn’t hurt your wallet.