South Carolina tenant screening should include eviction records as part of a rental background check. Eviction records can be searched either statewide or nationwide. Tenant screening agencies can report the applicant address history and if they paid their rent. It is a good idea for a property management company, HOA or a South Carolina landlord to request an eviction records search, especially if they have a rental application.

What is a South Carolina Tenant Screening Eviction Records Search?

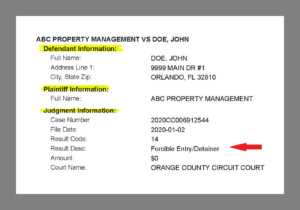

An eviction records search will report:

- Plaintiff Information: the name of the person or entity seeking the eviction.

- Defendant Information: name and address of the tenant.

- Judgment Information: Case Number, File Date, Result (if it is a new filing or Forcible/Entry Detainer, Amount and Court Name.

When a landlord alleges their tenant is unlawfully using the premises, they may ask the court to have the tenant removed.

First, the landlord must legally terminate the tenancy in writing. The landlord cannot evict a tenant without proper notice. Then, if the tenant does not move out or pay what is owed, the landlord can file an eviction lawsuit against the tenant. Courts refer to eviction actions as “forcible entry and detainer.” A forcible entry and detainer is an action by a landlord or property owner to remove the existing occupant who refuses to leave after appropriate notice.

If the landlord or property owner wins the case, the court may then grant a judgment for possession. If the tenant misses the hearing, the landlord or property owner may also win the case by default and receive a default judgment.

What is a Money Judgment?

In addition to the judgment for possession, the judge may also award a money judgment for damages. A money judgment is a court order that awards the plaintiff, which is the landlord or property owner, a sum of money. To recover money during a tenant eviction, the landlord must request a money judgment in the initial eviction complaint. If the judge awards the money judgment to the landlord, the tenant is legally required to pay all the money that is owed plus interest.

Money Judgments on a Credit Report

The credit reporting agencies do not report eviction records. That is why an eviction record search should be part of the tenant screening report. However, if a South Carolina property management company or landlord has received a judgment against the applicant and it is considered final, they may report the unpaid debt as delinquent to the credit bureaus. Once the three major credit reporting agencies, Transunion, Experian and Equifax receive the judgment, it will become part of the records section of the applicant’s credit report. Collection accounts remain on a credit report for seven years from the filing date or delinquency date. Bankruptcies, tax liens and civil court judgments also appear on the credit report. These filings can have a substantial impact on a credit score.

Money Judgments on a Bankruptcy, Liens and Judgment Search

Credentialing is required under federal law to protect consumer data. Individual Landlords and small homeowner associations may not be able to pass the credentialing requirements to receive credit reports directly. For these situations, Applycheck provides a Bankruptcy, Lien and Judgment search.

The Bankruptcy Search includes:

- Debtor name, address, file number and file date, chapter type, court district

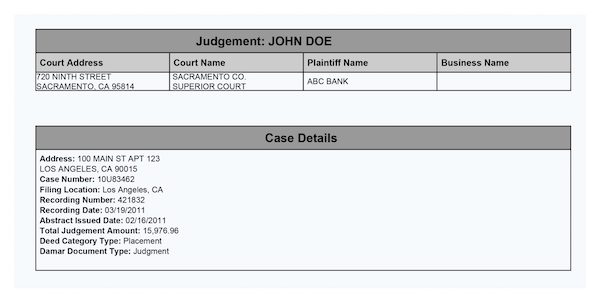

The Liens and Judgement Search includes:

- Debtor name, address, court case number and date, filing location, judgment or lien amount

The Bankruptcy, Liens and Judgment Search reports negative financial records of the applicant. These are nationwide searches. For example, if the landlord received a money judgment, the judgment appears on this report. This search does not report lines of credit detailed in a credit report, but significant negative payment issues of the applicant may appear on this report. A bankruptcy, lien and judgment search provides the landlord or property owner a look into the financial history of the applicant.

Benefits of an Eviction Records Search in a South Carolina Tenant Screening Report

An applicant’s past rental history can be an indicator of the applicant’s future behavior. The chance of an applicant previously evicted doing it again is 3 times higher than a renter that has never been evicted. Compare the cost of an eviction search to the court costs, time and loss of income and it is obvious that an eviction record search should be part of your application screening process.

Credit, Bankruptcy, Liens and Judgment, Criminal and eviction records are a good basis for a comprehensive South Carolina tenant background screening report. Applicants who have been evicted or have a low credit score, may find it difficult to find a rental. Most property managers or property owners will be unwilling to lease to a tenant with a poor history. Knowing the financial history of an applicant provides a means to understand who you are renting to and if you should complete the lease agreement or deny the applicant.

A rental applicant may want to run their own report to see what appears on their record before paying for an application fee.

Do I Need a Tenant Screening Agency in South Carolina?

No. Many USA based tenant screening agency can access credit, criminal and eviction records nationwide, statewide or in local courts. As a nationwide online tenant screening agency, Applycheck has access to multiple databases and can complete your South Carolina tenant screening for buyers and renters. The same reports can be used for short term rentals or roommates.

How to order Tenant Screening from Applycheck?

Either the Property Manager/Landlord/HOA/Realtor can order and pay for the screening report or the applicant can pay and order the report.

When a Property Manager/Landlord/HOA/Realtor orders a report, we provide both an online and paper authorization form so the applicant can authorize the screening. Upon completion of the report, Applycheck will email the person who placed the order, a link to the report.

If the applicant orders and pays for the screening, Applycheck will email the applicant a link to the report. The applicant can share the report by forwarding the email.