Experienced property managers look for applicants who can pass the test. Such as a good credit report and credit score with no major blips. A property managers tenant screening credit check and score will indicate someone who pays their bills on time with no large, outstanding debts. Good applicants make a property manager’s work easier and allow bills to get paid on time. Whether your association’s rules and regulations require a credit report, or just doing your due diligence, knowing the applicant’s prior history is a good indicator of how they will pay.

There are a lot of credit scoring models. Knowing how credit scoring works will help you choose what’s right for you and help you understand what gets reported.

What is FICO?

FICO, originally Fair, Isaac and Company, is a data analytics company focused on credit scoring services.

What is a FICO Credit Score?

A FICO Score is a 3-digit number (300-850) based on your credit reports. FICO is the most common credit score used by lenders.

How FICO Calculates Credit Scores

To determine credit scores, FICO weighs each category differently for every individual. However, in general, payment history is 35% of the score, accounts owed is 30%, length of credit history is 15%, new credit is 10%, and credit mix is 10%.

Types of FICO Scores

You may not realize that there hundreds more than 50 different versions that FICO sends to lenders. FICO scores have different names at each of the different credit reporting agencies.

Credit Agency FICO Scores

Each credit agency (Transunion, Equifax, and Experian) uses a customized version of each FICO edition. As a result, a consumer’s FICO scores from each agency may differ. Since its release, FICO has released five revisions: 1995, 1998, 2004, 2008, and 2014. Each version uses a different formula and produces a different score.

Industry Option FICO Score Versions

FICO offers “Industry Option” versions customized for auto loans, credit cards, installment loans, personal finances loans, and insurance. These versions have a score range of 250 to 900, so the scores are not fully comparable with “Classic” versions.

FICO Risk Score Classic 04?

FICO Version 4 (also called TransUnion FICO Risk Score, Classic 04) is one of the three primary scores mortgage lenders use in underwriting. Also known as the TransUnion FICO Risk Score Classic 04 (FICO has since dropped the 0 in 04. The “0” was first included since the score was introduced in 2004). The other two are FICO 2 and FICO 5.

Who uses FICO Risk Score Classic 04?

Fannie Mae and Freddie MAC, the largest purchasers of home mortgages on the secondary market, both use Classic FICO Scores. Applycheck in keeping with industry standards, provides the FICO Classic 04 Score with credit reports by Transunion as part of our background screening reports.

What major factors are considered for the FICO Risk Score Classic 04?

Model: Delinquency (90+ days) within 24 months

Score Range: 300–850. High score = low risk

Exclusion Criteria (the applicant must have):

- 1 tradeline within the last 6 months

- 1 tradeline at least 6 months old

- No deceased indicator

Primary Algorithms: 00P02

Other Information:

30-day buffer and 45-day inquiry dedupe of all auto and mortgage related inquiries. FICO uses a 30-day buffer and a process called “deduplication” on multiple inquiries for a mortgage or car loan, in effect counting them as one. Dedupe does not apply to credit card shopping.

Transunion Databases

The FICO Credit Scores use information from TransUnion’s consumer credit databases to assess a consumer’s risk of delinquency. The delinquency risk is determined by consumer charge-offs or bankruptcy over a 24-month period.

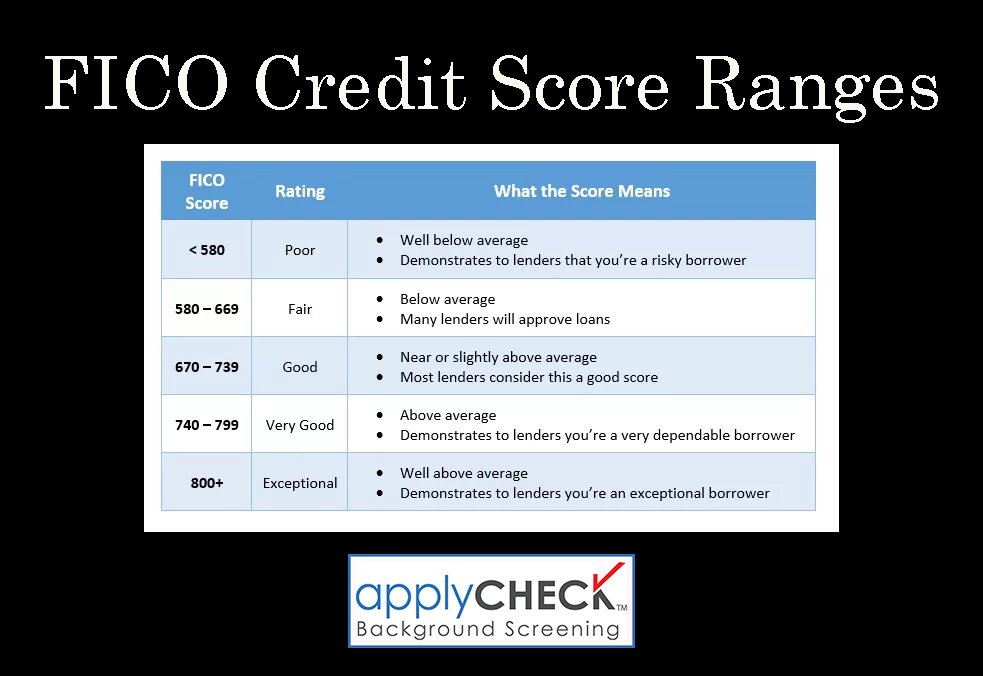

FICO Credit Scores help identify and separate reliable borrowers from those likely to become 90 or more days delinquent. The resulting credit score can then be identified by credit score ranges.

FAQ

Why does the applicant not have a credit score?

Sometimes an applicant’s credit report does not have a credit score. This is due to the Exclusion Criteria stated above. For example, if the applicant never applied for credit and therefore has no tradelines, there is no credit history for a credit score.

Why is an applicant credit score different from credit scores received elsewhere?

Tenant Screeing credit scores differ due to the type of score and date it was calculated. FICO Scores are computed from information within an applicant’s credit report based on the “as of” date. This may differ from scores obtained elsewhere that may have been calculated at a different time using information from a different credit bureau or even a different score model.

What is required to receive a property managers tenant screening credit check and score?

First, the applicant must authorize the screening in keeping with the rules and regulations of the Fair Credit Reporting Act (FCRA). The applicant must have a USA address and Social Security Number (SSN).

What if the applicant does not have a USA address and SSN?

USA credit reports require:

- USA address

- SSN

For foreign nationals, there are credit bureaus in other countries. For example, a Canadian can receive a Canadian credit report with credit score. Canadian credit reports require a Canadian address and Canadian Social Insurance Number.

What if the applicant resides in the USA but does not have a SSN?

For foreign nationals residing in the USA without an SSN there are other options. Applycheck provides a Bankruptcy, Lien and Judgment search. These reports will not include detailed credit data or a FICO Score but will report negative financial records. For example, if a landlord received a money judgment, it will appear on this report.